A Quick Roth History Lesson

One of the forefront topics in the world of retirement planning was created with the advent of the Roth IRA: tax-free growth. The concept is simple – pay taxes now instead of later. Politicians like it because it helps to increase current tax revenue and defer the lower tax proceeds to a future generation of lawmakers. Investors value the ability to pay a known tax liability today for tax-free growth in the face of uncertain future tax rates. From its humble beginnings to being used by wealthy investors to shelter large amounts of wealth from taxation, the history of the Roth is rich. Regardless of any headline controversies, its use has continued expanding in retirement planning strategies which signals that the Roth may be here to stay.

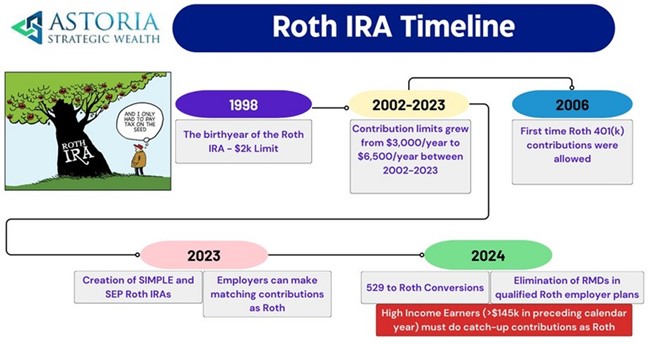

At its first inception, the contribution limit was restricted to merely $2,000 1. As the contribution limits have grown throughout the years, so did the reach of using a Roth:

- 2006 introduced Roth contributions to 401(k) and 403(b) plans as well as the comparatively higher available contribution thresholds over IRA limits.

- Prior to 2010, Roth conversions were not available for anyone with an Adjusted Gross Income (AGI) of over $100,0002.

Today, income limits still apply for direct Roth IRA contributions which led to the creation of the “backdoor” or “two-step” Roth contribution process. - Fast forward to 2023 and the Roth IRA contribution limit has grown to $6,500 ($7,500 for those age 50 and older) and the Roth 401(k) contribution limit is $22,500 ($30,000 for those age 50 and older).

While these limits sound modest, some select entrepreneurs have figured out a way to use them to amass large tax-free fortunes in recent years. According to a Forbes report, as originally investigated by ProPublic, one of the founders of PayPal, Peter Thiel, was able to accrue $5 billion in his Roth IRA3, 4. He did so through systematically purchasing shares of start-ups inside his Roth IRA (a very risky endeavor), selling once they skyrocketed in value, and reinvesting (tax-free) in other start-ups. Is this exploitation of a well-intentioned tax- law? Maybe. Is it a brilliant execution of the tax laws available? Absolutely.

The stories of Peter Thiel and other ultra wealthy individuals have drawn scrutiny by the public and lawmakers alike regarding the intention of Roth accounts to be used by the general public to incentivize retirement savings. Despite the headlines outlining this perceived manipulation, the Secure Act 2.0 of 2022 furthered the application and accessibility of this strategy. Roth contributions, as of 2023, are now available through SIMPLE and SEP IRAs which helps benefit small employers who do not have 401(K) plans. Employers are also allowed to make their matching contributions as Roth contributions – with a caveat – so long as the plan allows. There may still be administrative and procedural hurdles before this is widely available, but the road has been paved to allow these matching contributions to be via Roth. It is important to recognize that simply because something has passed in law does not mean it is instantly available for use. It will continue to take time for the IRS, payroll companies and systems, custodians, and financial institutions to catch up to what is now and soon- to-be available by law.

The spirit of tax-free growth funding (“Roth”) has not remained exclusively with the retirement and estate planning community either. It has found its way into the world of health care too. Commonly referred to as a “Stealth Health Roth”, proper utilization of a Health Savings Account (HSA) can provide not only current tax savings on contributions, but also tax-free growth and distributions when certain parameters are met. For those fortunate enough to be able to participate in an HSA (a high-deductible health plan is a requirement), families can set aside an additional $7,750 ($3,850 for individual plans and a $1,000 catch-up contribution for those 55 and older in both family/individual plans) for qualified medical expenses.

Unlike the HSA’s cousin, the Flexible Spending Account (FSA), funds inside of an HSA are not required to be spent down every year and are able to be invested. As such, please consult with your HSA administrator for the specifics of your plan. The diagram below outlines many of the Roth/Tax Free Options available. Please reach out to your financial advisor to determine how (or if) you may be able to implement any of these strategies in your financial plan.

Upcoming Changes

Nobody knows the fate of the Roth in the long-term – as anything in the tax code is subject to change – but in the short-term there are additional features on the horizon to evaluate. One thing is clear: the Roth’s role as a long-term piece of the retirement-puzzle continues to take shape.

529 Plans

Beginning in 2024, the door has opened for unused funds from existing 529 plans to roll them into a Roth IRA. Restrictions apply to lifetime and annual contribution/rollover limits as well as owner and holding period requirements. If you have questions about these limitations, reach out to your financial advisor to discuss the viability of pursuing this rollover opportunity. But, the creation of this 529 to Roth conversion helps alleviate some concerns in “over-funding” education accounts for the family.

Required Minimum Distributions

2024 also welcomes the elimination of Required Minimum Distributions (RMDs) for Roth funds in qualified employer sponsored retirement plans, such as 401(k)s. Roth IRAs currently have no RMD requirements, and this new provision from the Secure Act 2.0 puts Roth funds in qualified employer plans on the same playing field.

Employer Retirement Plan “Catch-Up” Contributions

Although many changes have positive impacts for those who choose to use them, not all of them are beneficial for everyone – or even voluntary. Starting in 2024, individuals who are eligible to do catch-up contributions and are high income earners (income >$145k with their employer in the preceding calendar year), will be required to do catch-up contributions as Roth. Not all employer plans allow Roth contributions, so the phrasing in the law may have negative ramifications for plans without a Roth feature (eliminating ALL catch-up contributions available). Lawmakers will need to address these issues to ensure the spirit of the legislation does not have unintended consequences. The catch-up contributions are not all bad news, though. A small window of people, ages 60-63, will be allowed to make larger catch-up contributions than their counterparts in 2025 and beyond. This amount is the greater of 50% of the existing catch-up contribution or $10,000 (indexed for inflation). For those who are interested in maximizing their Roth contributions this is just another avenue to do so.

Need Some Help Thinking Through the Options?

We at Astoria Strategic Wealth believe in the significant power of the Roth when it comes to retirement, tax, and estate planning. What once started as an idea between Senators Roth and Packwood has flourished in scope and become a household approach in planning for the future. Is a Roth right for you and your family? A simple question with no simple answer. Our team at Astoria is here to partner with you in evaluating these tools for you and your goals.