All Eyes Are On – Different Things?

FANG to FAANG to ?? Today we are on to “The Magnificent 7”. Women continue to make history, and should you invest at all time highs?

Markets are forward looking and there is no shortage of things for investors to focus their sights on currently. When some events approach, market volatility often picks up as people plan around two (often different) results. However, having a litany of important things to focus on can sometimes lead to less volatility since not everyone is emphasizing (or pricing) the same outcome at the same time. 2024 is an important year in a number of ways as there are billions of people voting globally – approximately 49% of the world population is meant to hold important, national elections this year (Source: Time) which can impact consumer spending behaviors.

First Quarter 2024 Summary

The first quarter had a steady start for many risk-oriented assets. Most equity markets across the globe are up mid-single digits to up double digits (like large-cap U.S.). A few drivers of the rally may be the continued expectation of lower interest rates in the last half of 2024 coupled with support from an A.I. driven craze.

Broader fixed income strategies finished the quarter slightly down as interest rate expectations continue to set in. While coupons and interest on high quality U.S. fixed income remains significantly higher than the last decade, the income earned for the first quarter of the year was not quite enough to offset the higher-for-longer rhetoric that modestly drove down existing bond prices.

Valuations improved in most asset classes throughout 2023, so the initial tailwind of lower valuations from the otherwise declining market environment of 2022 is arguably behind us. From here, in order to see continued strength in the rally, earnings may need to see faster growth for companies. Of course, there is always the chance that prices could rise absent a strengthening in earnings, but many are eyeing how A.I., higher interest rates, and lower inflation will trickle down through the economy.

Inflation has settled down, but it remains above the U.S. Fed’s 2% target, so there is still work to be done in helping bring levels down to the long-term trend. Given the path of working toward normal interest rates and inflation, the Fed reiterated their expectations for three interest rate cuts this year- half of what many market participants had expected just a few months ago.

One area sounding the cautionary bells is commercial real estate since it continues to see potential weaknesses forming. Companies continue to seek solid footing in a post-COVID environment, strained by the push and pull of work from home policies and consumer preferences. A significant amount of the debt is floating, so the implications for higher-for-longer interest rates could potentially spell troubles ahead for a lot of institutions.

Wishing you a happy spring and a great start to summer. Read on as we discuss key factors impacting the economy, renewed economic strength from women, and the changing corporate dynamics at the top.

An Evolving Environment: A Changing of the Guards

It wasn’t long ago that headlines referred to the top U.S. public technology companies as the FANGS: Facebook, Amazon, Netflix, and Google. Then, in 2017, it was expanded to include Apple (ha! – thinking back, you might have thought Apple was there all along) and thus was born the FAANGS. Over time, Facebook became Meta, and Google became Alphabet, so the acronym gets further and further muddied. These giant technology companies have demonstrated a powerful and dramatic impact on driving the market’s performance over the last decade. In fact, the top 10 companies of the S&P 500 currently account for 25% of the entire index’s earnings.

However, it is interesting to reflect on the evolution of these companies. And, how easy it is to forget that the “N” could be inconspicuously swapped out for NVIDIA these days and few would notice the difference. What history has shown is that there are strong competitive forces at work across the globe that ultimately drive asset prices and markets higher. New ideas are born, new companies are formed, and even companies that have been in existence for a long time suddenly find themselves in the right place at the right time as technology advances. It is the evolving nature of how the economy adjusts and the businesses underlying it that allows us to adapt to our changing environment and potential disruptions that could derail forward progress.

Technological changes are seldom linear or follow a simple pattern. This constant evolution is why markets tend to overreact in the short-term to negative news yet underreact to the positive swings in the market over the long-term. Future, less predictable (although positive) outcomes are harder to quantify than news of something more imminent.

As all things A.I. continue to ramp up, semiconductors are top-of-mind. How they are made, where they are made, and what technologies they are made to support are each individual questions that create tremendous potential and opportunities. It also shines light on various constraints now facing companies, regions, and resources – much like supply chain disruptions of the recent past highlighted opportunities needing improvement. And, despite decades worth of information in our digital world, some even suggest A.I. does not have enough data to consume to be most effective – both an opportunity and a problem!

In other areas of the economy, change is no less afoot. The Baltimore Francis Scott Key Bridge collapsed from a ship collision in March (Source: CNN). While it is a devastating event that has ripple effects for years throughout the local and global economies, it is an example of unexpected events that can have a profound extended impact. There is undoubtedly a long road ahead to rebuild the port in the physical ways we see, but also in how and where people conduct business. Just as insurers, governments and companies raise questions on ancient maritime laws and evaluate who and what is responsible for helping rebuild this particular port and bridge, it is important that we recognize that sometimes events happen that disrupt the status quo. The insurability aspect or replacement cost of something can occasionally be brought into question. On a personal level, many property owners are grappling with insurers leaving their state or exiting entire markets which drives home the need to have a qualified team supporting you in the twists and turns that come along.

Women in The Spotlight & Investing at All Time Highs

Women’s history month concluded with some spectacular support of March Madness for Women – Iowa-LSU’s basketball game averaged more than 12.3 million viewers (Source: Just Women’s Sports). As well, the number of viewers watching totaled more than “every women’s college basketball game ever,” “every ESPN college basketball game ever”, and “every NHL game last season” (Source: Front Office Sports).

Other record shattering displays of resilience continue to be evident with the successes of Taylor Swift and Beyoncé with their new album releases continuing to write a new history for female powerhouses. The economic impact globally from just these three examples are astounding, and it continues to paint a picture of a resilient consumer, strong economy, and the evolution of consumer preferences.

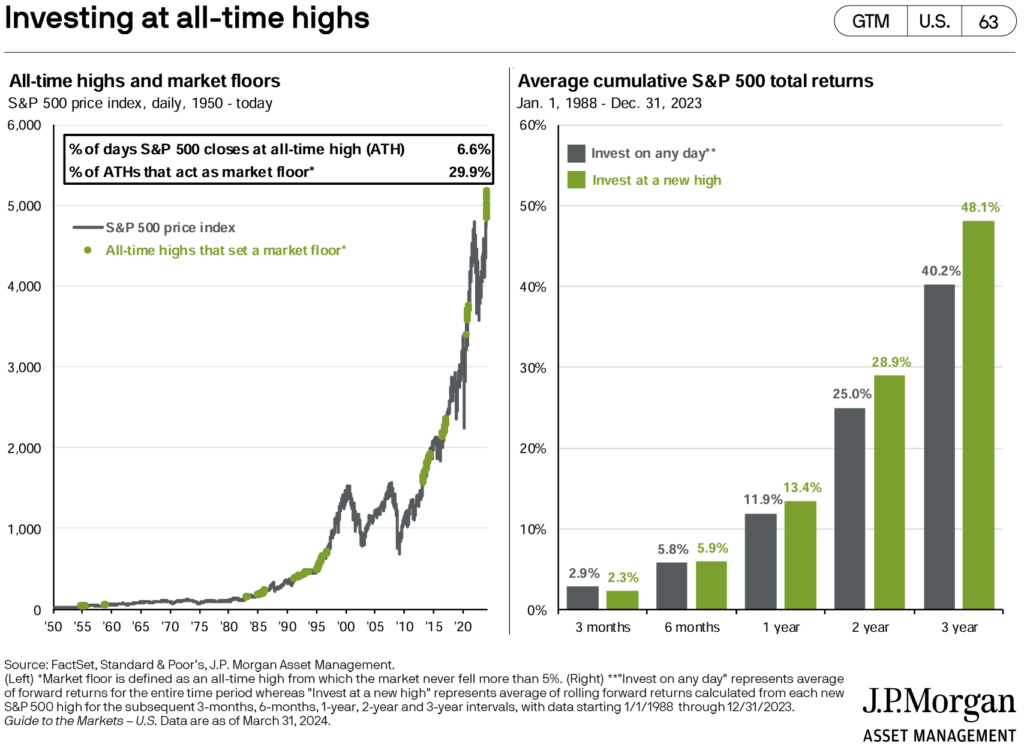

With many of the positive developments occurring in front of our eyes, it is not surprising that markets are hitting all-time highs (from having last peaked in early 2022). It is also natural to question when the next market decline may happen since, on average, markets see a decline within each year of 10% or more at least once. So, should someone sell, stay in cash, and “wait” for the market to decline? Historically speaking, market highs tend to beget more market highs!

As you can see in the chart below, there are a significant number of time-frames wherein waiting for a 5% drop to get back to the current level never ends up happening. Further, nearly 30% of the time going back to the 1950’s, the percentage of times an “All-Time-High” was achieved actually became the next floor (for which the market never fell more than 5%). Every cycle is different from the next, but there is a lot we can glean from the past in seeing how investors and consumers behaved in prior periods of time. Markets continue to build upon themselves over time, else they would not be anywhere near the levels they have attained today.

Closing Remarks

Inflation has moderated and fallen to more comfortable levels, but there is still room for improvement toward the 2% target. The current inflation readings have come down to 3.2% (Source: BLS) from a peak of 9.1% in 2022. That is a tremendous “normalization” that happened since inflation reared its ugly head coming out of the Global Pandemic. Let us not forget, however, that inflation is a change in price levels from one point to the next. Once the newer price is established (i.e. $2.36 for a Big Mac in 1996 vs. $5.69 in 2024), the newer-higher price tends to sustain. So, inflation coming down to “normal” is simply addressing the rate of growth from this point and not the new pricing that is established on things such as home, food, and transportation.

With the “higher-for-longer” interest rate cycle we currently find ourselves in, lots of assets, purchase decisions, and debt servicing are related to current interest rates. Most expect that interest rates may start to decline in the last half of the year. While markets can be good at pricing in what they can expect, it is often an unexpected event that can cause models and assumptions to adjust (sometimes rapidly). So, to the extent that interest rates remain higher than what is currently expected or we head into a cycle where interest rates need to start declining as a result of deteriorating economic fundamentals, it may bring higher volatility. Also, with all the important events on the horizon – don’t forget the Summer Olympics in Paris! – it creates the conditions for higher volatility as events get closer that have an “either” “or” outcome.

The patient investor keeps an eye for the long-term fundamentals of where the markets are headed over time. Technologies including A.I. could be a potential tailwind that helps companies, individuals, and countries steering toward longer term trends. Striking the balance between doing the jobs humans want vs. the jobs that robots can do will be important!