Where’s the #1 place in America to live? According to The Today Show (and me @Jake Ridley), it’s Round Rock, Texas. With a rejuvenated downtown, beautiful landscapes like Brushy Creek, great businesses, schools, and location, it has everything. It’s no wonder the population has more than doubled in the last twenty years, growing from 60,000 to over 130,000.

With all this population growth and opportunity, there must be more financial planners than you can shake a stick at, right? Well, not really. Here is the reality:

- There are 195 Registered Representatives in Round Rock. These are people licensed to sell or give advice around investments. So, 1 for every 680 people in Round Rock. Not bad.

- But what if you want an actual financial plan, not just investment help? Of those 195, 28 are CERTIFIED FINANCIAL PLANNER™ Professionals offering comprehensive financial planning services (i.e., holistic financial planning). This is 1 CFP® for every 4,727 people.

- Then, of those 28, 6 are fee-only. Now we’re at only 1 fee-only firm for every 21,667 people.

So, finding someone to help with investments in Round Rock Is pretty easy. Finding a CFP® to create a plan for you is more challenging. But finding a fee-only CFP® to create a plan for you is hard – only 1 for every 21,667 people. And to make it harder, “financial advisor” can mean anything, from an insurance salesman to a comprehensive fee-only financial planner. My goal is to bring some clarity to this murky situation and explain why I am passionate about providing this service to those in Round Rock. Full disclaimer: I’m a CFP® and work at a fee-only firm, so I am biased!

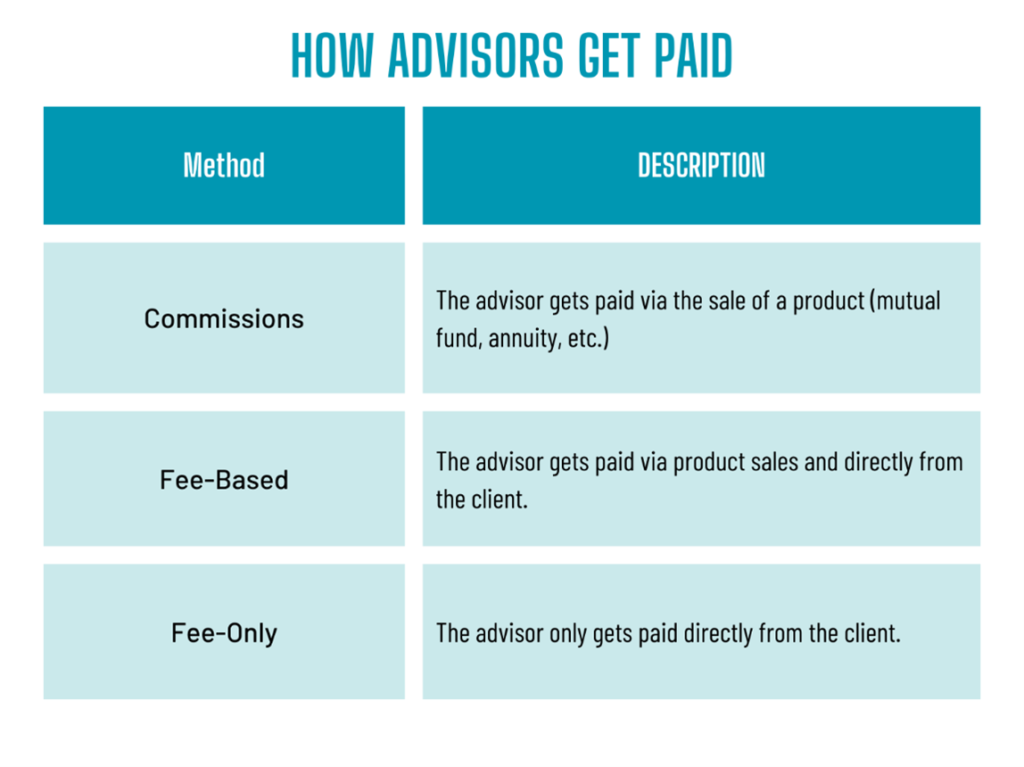

How Advisors Get Paid

Advisors can get compensated in basically three ways: through commissions (i.e., product sales), commissions and fees (sometimes called “fee-based”), and fee-only (i.e., paid directly by the client).

Commissions

Commissions are charges embedded in the investment products being sold. This commission can come in all sorts of ways – sales loads, trailing fees, etc. However they are included, the idea is the advisor makes money from the sale of a product (annuity, insurance, mutual fund, etc.).

Fee-Based

Fee-Based is a combination of commissions and fees. The advisor can get compensated by selling a product and also directly by the client.

Fee-Only

Fee-Based is a combination of commissions and fees. The advisor can get compensated by selling a product and also directly by the client.

Is Fee-Only Best?

Here comes the self-promotional part. I’m a CFP® with Astoria Strategic Wealth. We’ve been fee-only since the beginning (over 20 years). So, I am certainly biased. But here is why we’ve chosen this model.

When your compensation is tied to the products you recommend, there is an inherent conflict of interest. And the client never really knows if what is being recommended is in their best interest. In fact, legally, commission-based and fee-based advisors only have to recommend what is “suitable” or basically what is good enough.

Not the best, but good enough.

On the other hand, a fee-only advisor is held to a “fiduciary” standard or what is in the best interest of the client.

Additionally, the transparency of knowing what you are paying is critical as well. Once you know what you are paying, you naturally ask, “Is what I am receiving worth it?”.

While fee-only may not be perfect (as we’ll look later), I do think it is the best at disclosing and mitigating conflicts of interest.

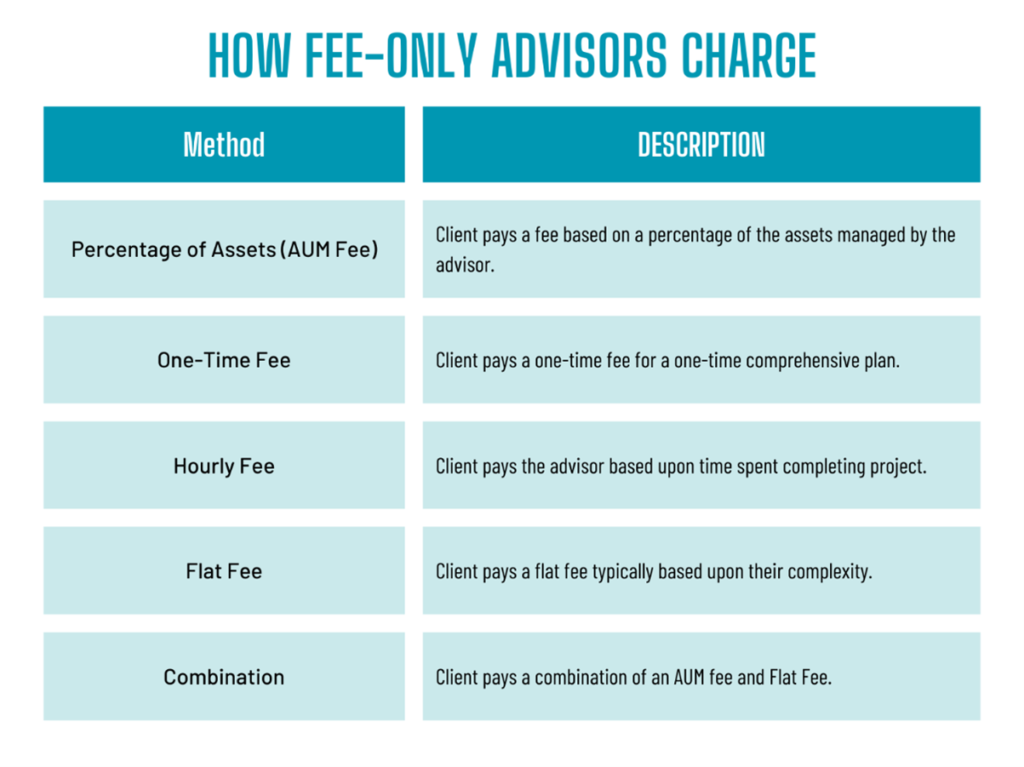

How Fee-Only Advisors Charge

Since fee-only advisors are paid directly by the client, there are several ways advisors charge.

Percentage of Assets (AUM Fee):

This is the most common method of payment for fee-only advisors. In the percentage of assets model the client pays a fee based on a percentage of the assets managed by the advisor. As an example, an advisor charges 1% (a common fee) on the $1,000,000 in retirement accounts they manage for the client. This comes out to $10,000/year and fluctuates based on the value of the accounts (i.e., if the accounts grow, the fee increases, if the accounts decrease in value, the fee decreases).

Most advisors also reduce the percentage of assets fee at certain asset levels (i.e., breakpoints). This model typically works best for those with accounts large enough to warrant a higher service level. In general, the greater the investment account values, the greater the complexity, and therefore greater planning opportunities (assuming they offer planning services).

Keep in mind, though, that some advisors only manage investments and do not do any financial planning. Again, I’m biased, but I don’t think you can manage investments well without understanding the “why” via a financial plan. So, some advisors charge 1% just for investment management, and some charge 1% for investment management and financial planning. Asking the advisor if they include ongoing financial planning as a part of the fee is an important question to ask.

One-Time Fee:

This payment method is geared for one-time engagements. The planner creates a financial plan, delivers it to the client, and then (usually) has some period of interaction (e.g., 6 months) for the client to communicate with the advisor. This model works best for those with relatively simple needs and the desire/ability to implement the recommendations on their own. Basically, the client needs some guidance from a professional and can handle the rest.

Hourly Fee:

This payment method is just what it sounds like. A financial planner charges the client by the hour. This engagement is similar to the one-time fee engagement. It’s also best suited for the same type of client: those that just need someone to tell them what to do, and they’ll get it done.

Flat Fee:

The flat-fee arrangement is a relatively new development. The idea is to base the fee, not on assets managed, but a flat amount usually based upon complexity and services delivered. This works sort of like a subscription where you pay a monthly, quarterly, or an annual amount. For example, a flat-fee advisor may charge a flat $7,500/year regardless of the amount of assets managed.

Combination

Some advisors (like Astoria) charge a combination AUM fee and a planning (i.e., flat) fee. The objective is to more precisely align the value provided with the price. For example, the AUM fee may be fixed (.45%) but the planning fee may be variable based upon complexity.

As you can see, there are several different ways for advisors to charge as fee-only advisors. I would recommend talking with several different types to get an understanding of which may be the best fit for your situation.

Conflicts of Fee-Only Advisors

So that this doesn’t completely sound like an infomercial, there are some potential conflicts of interest with fee-only advisors. No model is without conflicts of interest and here are a few potentials.

Percentage of Assets (AUM Fee): The most obvious conflict of interest with an AUM only advisor is that their compensation is based off the account balance. The larger the balance the larger the fee (in general). What happens if the client wants to pay off their mortgage? Paying off the mortgage reduces the AUM, which reduces the fee, which presents a conflict. Taken to the extreme, even retirement distributions could prevent a conflict; the more distributed, the lower the balance, the lower the fee.

Hourly Fee: The potential conflict here is pretty obvious. The more time spent on a client’s plan, the more the advisor gets paid. The conflict of interest, then, is to maximize hours spent. Again, the way to mitigate this is the fiduciary standard. You can also ask for a range up front, as most advisors have a good idea of the scope of work required.

Flat Fee: Even flat-fee advisors have a potential conflict. If someone is paying the advisor a flat fee, regardless of time spent, then the advisor has an incentive to minimize time spent. This could mean pushing implementation of a recommendation completely on a client (e.g., make a recommendation to get an estate plan, but not provide any connection to a recommended set of estate attorneys). Or rather than managing the client’s investments, the advisor makes an asset allocation recommendation and puts the onus on the client to implement. Both reduce the time spent on the client, which maximizes profit for the flat fee advisor.

What’s the Best Option for You?

As you can see, no model is perfect. As soon as someone charges a fee for something (advice or product) there will be a conflict. What’s the best way for a client to manage these conflicts?

Here are two ways.

First, transparency. Understand the fee, understand where the conflicts lie, understand the service, and then decide whether the value justifies the fee.

Second, if the advisor is a fiduciary, they should have examples of times when recommendations were made that were not in their best interest. Ask them for examples. Speaking personally, our firm has many examples of making recommendations not in our best interest: paying off mortgages, delaying Social Security, increasing retirement distributions, keeping cash outside of our management, etc. All these decisions reduce our fee in some way but are recommended because it’s in the client’s best interest (i.e., the fiduciary standard).

The key is to have a transparent engagement built upon trust that provides value.

Fee-Only Financial Planning in Round Rock

Bringing this back to the beginning. Why do I think providing this option and service to those in Round Rock is important? First, investments can’t be managed well without a financial plan. There needs to be a “why” behind those investments. That’s why I’m a big believer in the CFP® designation. Second, having price transparency as a fee-only advisor allows a client to make the best decision on whether the value provided justifies the price. And it limits (not prevents) conflicts of interest. Is this model perfect? Nope. But it’s the best that’s out there right now and this is why I’m passionate about providing this service to those in Round Rock, TX.