Are we in another dot-com bubble?

Is consumer/government debt going to be our downfall?

Let’s look at the facts.

“The market feels like a house of cards.” This was a comment made by a client during a recent planning meeting. And I am certainly sympathetic to that feeling.

It also doesn’t help that there is the near constant drumbeat of negative news: the national debt, consumer debt, the AI vs. dot-com-bubble comparisons, and everyone’s favorite – the election. Even though the U.S. stock market is up over 22% as of 9/30, it can feel like we’re living on borrowed time.

As an antidote to that pessimism, let’s look at the facts. Do these facts mean there is no risk? Of course not. There is always risk and uncertainty. As I’m typing this, Iran has fired ballistic missiles at Israel. But fortunately, for a very long time those that have embraced market risk have been well rewarded. So, let’s look at five facts that counter current pessimistic market takes.

“The Market is Being Propped Up by AI”

This is a common one I hear, and it has some merit. When you think back to the last 18-24 months, some scary things happened. We had multiple banking collapses, inflation rising to forty year highs, multiple tech stalwarts laying people off, the Ukraine war intensifying, two assassination attempts on a presidential candidate, and much more. With all that scariness what has the U.S. market done? It’s been on a tear, up over 60% in two years. And in the early stages of the rally, it was driven by AI. The most notable being Nvidia up over 850% in the same period – woah. This doesn’t feel right.

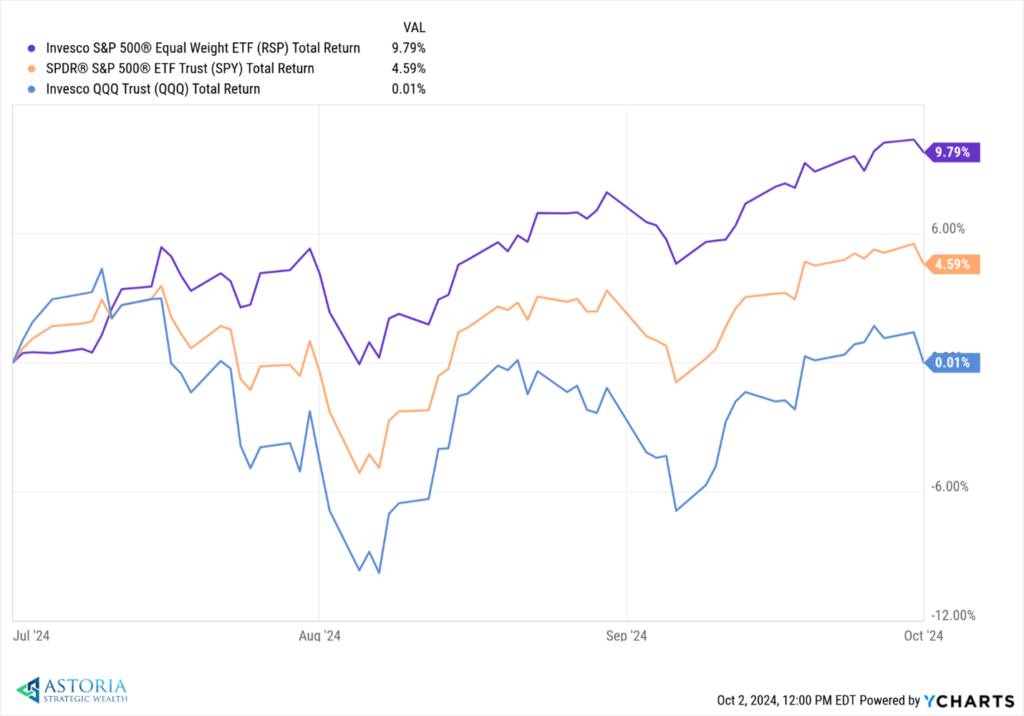

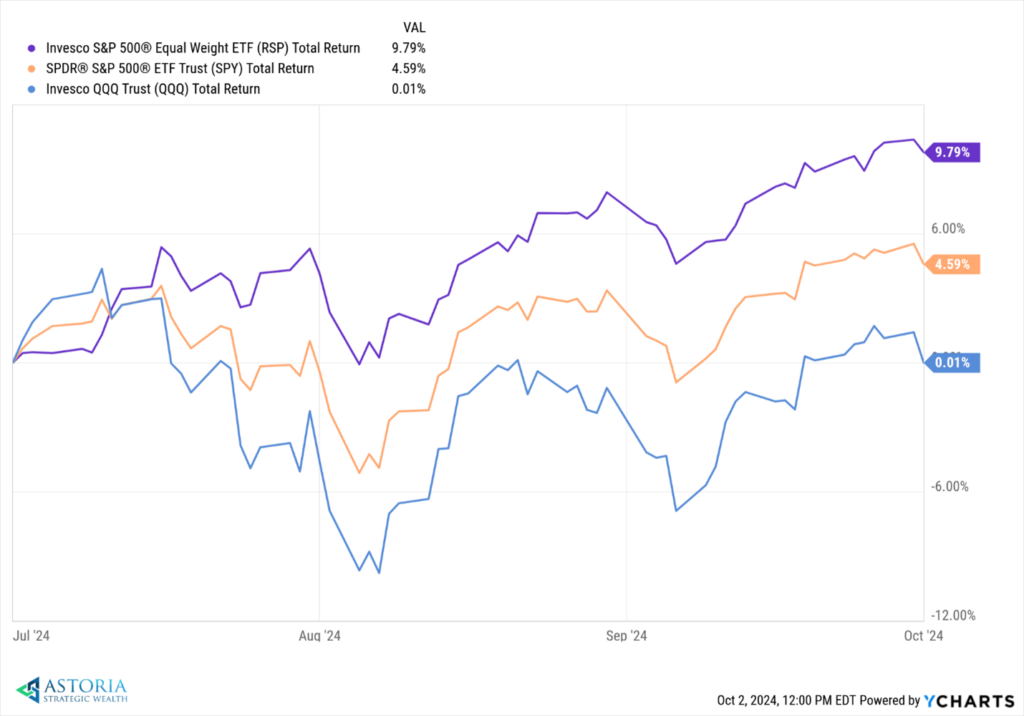

Here’s the reality, though. Since 7/1 of this year the market rally has dramatically broadened. In fact, most of the growth of the past three months has been driven by non-tech companies. One way to see this is to compare a tech concentrated investment (ticker: QQQ) to a less tech concentrated investment (ticker: RSP). When you look, you’ll see that RSP has outperformed QQQ by almost 10%. QQQ is basically flat in the last 3 months. What has driven the market in the past three months is not AI – its things like industrials and financial companies.

While I was certainly not complaining about AI driving the market (the alternative is worse!), it feels even better to see the market rally broadening into other areas.

Additionally, the rally has even broadened into more beaten down areas like International and U.S. Small Caps.

This is all good news.

“Today Feels Like the Dot-Com Bubble”

You’ve probably also heard comparisons to today and the dot-com bubble of the 90’s. There are definitely similarities (which is what makes for a believable argument!). The main similarity between the two is the theme: a new, supposed revolutionary technology that is going to fundamentally change how we operate. In the 90’s it was the internet. Today it’s AI. And similar to the dot-com bubble, there are many companies trying to ride the wave by bolting on “AI” somewhere in their name or website.

In the 90’s, Cisco was the company that was going to provide support for all things internet. In the market’s eyes, they were going to benefit the most from the dot-com boom. Unfortunately, Cisco’s bubble popped. It dropped more than 80% from its highs in 2000 and still has not recovered its price from over 20 years ago. Ouch.

Likewise, today’s AI ground-zero company is Nvidia. As mentioned above, Nvidia is up over 850% in two years.

It must be in a bubble then, right? Well, not necessarily.

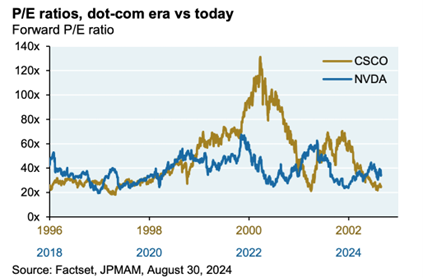

The chart above compares the PE ratio of Cisco in the 90’s to Nvidia today (back to 2018). A quick note, the PE ratio simply measures how much the stock costs (price) compared to its profitability (earnings). The higher the PE ratio, the more profitable the company has to be to justify its stock price.

Cisco reached a PE ratio of almost 140x earnings (this is really high) in the dot-com bubble. Nvidia, however, actually has a lower PE ratio today than it did in 2018. This means (so far) its profitability has justified its price.

Nvidia, today, looks way different than Cisco from the 90’s. Full disclaimer, so I don’t lose my job. This is not me telling you to go buy Nivida. Just making an observation.

“Consumer Debt is Out of Control”

You’ve probably heard the stats about consumer debt being at record levels. While that’s true, it’s really a half-truth. First, it doesn’t account for inflation. We’re constantly at record levels of pretty much everything that’s tied to a dollar: wages, home prices, you name it. That’s why it’s important to adjust these types of numbers for inflation. But ultimately, what really matters is the ability for people to support their debt. You do this by comparing their debt payments as a percent of disposable income – i.e., can they pay the debt back?

According to the above, we’re actually at levels similar to what we had in the 90s. And nothing like what we had leading up to the Great Financial Crisis in the early/mid 2000s. As of right now, people are in a good spot to service their debt.

The Government is About to Collapse Because of Its Debt

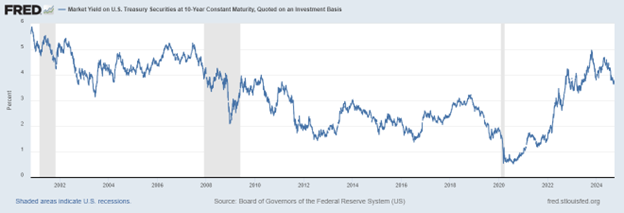

The government debt is worrisome. And neither candidate currently has a plan to address it. But luckily, we have a mechanism to show how bad/good U.S. debt is as an investment: the market interest rate. This is the interest rate that the government pays on treasuries (US government debt) when it needs to raise money. This system is similar to how personal debt works. If you have bad credit, you pay higher interest rates – because the risk of you not paying someone back is higher. The government bond market works the same way.

If U.S. government debt is perceived as a bad investment (people don’t want it) then its interest rates would go higher until it became more attractive.

Right now, that’s just not the case. The chart above shows the average interest rate on 10-year government debt going back 20 years. Today, the 10-year interest rate is actually lower than it was in the early 2000’s. The market (people, institutions, other governments) still sees U.S. debt as an attractive investment. If not, you’d expect to see higher interest rates.

This doesn’t completely get the government off the hook, nor am I saying, “all is well”. I’m just saying the market is not ringing any alarm bells currently.

There’s Always Risk but I’m Optimistic

There is always risk and uncertainty in the markets. When things are bad, the risks are obvious. When things are good, usually the argument is something like, “things are too good”. Are we at a market top? No clue. As much as people would have you believe otherwise, this is nearly impossible to know. However, when I look at the facts compared to some of the arguments being made today, I’m optimistic.

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. Performance reported gross of fees. You cannot invest in an index. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances