Tax-Advantaged Giving Anyone?

There are probably nearly as many ways and reasons to give as there are organizations and individuals seeking support. Our time, skills and resources are always in demand. With a little planning, however, you can help your organizations and lower your tax bill.

What Constitutes a “Gift” to Charity From a Tax Perspective?

A “gift” to charity is simply a gratuitous transfer of property to a charitable organization. The key is that your gift must be some kind of property–your time or personal services do not count (for tax purposes)! There are several different types of property that can be donated to charity, and a gift is limited only by your imagination.

Through tax legislation, Congress has attempted to encourage charitable giving because it is good social policy. Almost every charity depends on individual contributions to remain financially solvent. As a result, charitable giving has become interconnected with tax laws, which have grown more and more complex (shocking we know).

Congress has sweetened the pot for taxpayers who donate to qualified charities. First, you generally receive an income tax deduction in the year you make the gift. Second, you do not have to worry about gift tax because federal gift tax does not apply to charitable gifts. Third, charitable gifts serve to reduce your taxable estate, thus reducing your potential estate tax liability. It is this last area–estate tax–where charitable giving may produce the greatest tax benefits. Over the next 30 years, an estimated $8 trillion of assets will pass from one generation to the next, resulting in the assessment of significant estate taxes. One solution to minimize these estate taxes is charitable giving.

Methods of Giving

Somewhere between cash and clothing donations to more complicated trusts, foundations, and donor-advised funds, there is a reasonably simple method that will allow most of us to financially support qualified charities that will also benefit our tax returns. Specifically, this method is referred to as “donating appreciated securities”. You’ll find this method of giving beneficial to your 1040 in a couple of different ways.

How Does it Work?

You start by looking for publicly traded securities (stocks, bonds, mutual funds, Exchange Traded Funds – ETFs, etc.) that reside in a taxable account (e.g., not an IRA or 401(k) plan, etc.) that have appreciated in value. You’ll want to look for securities that you have held for at least one year plus a day as they are then considered to have “long-term capital gains”. (“Long-term capital gains” are taxed differently than “short-term capital gains”.) The value of a gift of long-term capital gain property is the fair market value of the property on the day it is gifted. The value of a gift of short-term capital gain property is limited to your cost basis (what you paid for the securities originally), and therefore there is no tax value/savings on the appreciation.

Once the shares are transferred to the qualified charity, you will generally be able to take a tax deduction for the fair market value of the securities on the day of transfer, based upon the average of the “high” and “low” trading prices for that session. And, because you are donating long-term capital gain property, you (and the charity) avoid any capital gains tax on the appreciation amount.

An Example

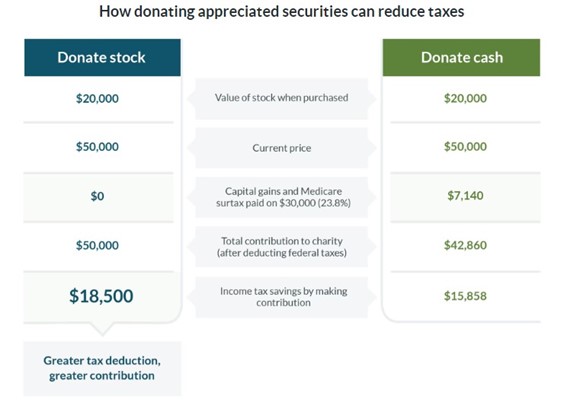

Justin and Katelyn would like to make a $50,000 charitable donation for the year. They have identified that they own Vanguard Total Stock Market Index (VTI) in their Joint Tenants brokerage account. Their cost basis is $20,000 and the value of the security today is $50,000. So, the difference between their cost basis and the current market value is $30,000; this is the appreciation amount. They confirm that they have owned these securities for at least 366 days.

If Justin and Katelyn transfer VTI to a qualified charity, they will receive a tax deduction for the full value of the gift ($50,000), assuming that they won’t be phased-out or limited on their deduction. If their marginal tax rate is 37%, the deduction is worth $18,500.

Additionally, they avoid paying capital gains tax on the appreciation amount of $30,000. At a capital gains rate of 23.8%, that’s another $7,140.

The result? The charity received $50,000 and their cost for the gift was $20,000. Not bad! What if you had just sold the stock and then donated cash? Since you would pay capital gains on the appreciation, the net proceeds would be $42,860. This would lower the deduction amount to $15,858 as well. The charity receives more and you receive a higher deduction; a win-win for everyone.

How Can You Get Started?

You or your advisor can help identify securities that would be beneficial for this type of giving. Typically, a letter of instruction is required to transfer the shares.

One other gifting idea: If you are taking Required Minimum Distributions from your IRA accounts (Beneficiary IRAs do not qualify unless you are the surviving spouse who elected to treat the inherited IRA as your own), you can speak with your tax accountant to see if a Qualified Charitable Distribution (QCD) makes sense for you. By making a qualified charitable distribution (QCD) from an IRA directly to a charitable organization, you are able to exclude the distribution from gross income. These gifts, also sometimes referred to as “Charitable IRA rollovers,” would otherwise be taxable IRA distributions. The law was originally scheduled to expire in 2007, but was extended periodically through 2014 by subsequent legislation and finally made permanent by the Protecting Americans from Tax Hikes (PATH) Act of 2015.

We look forward to helping our clients and our community with these tax saving strategy for charitable giving and would be happy to answer any questions you may have. In the end, if this approach raises the level of community philanthropy, we believe that will likely lead to more good that gets done by so many hard working, selfless causes that always seem to be striving to do more.

As we are not tax preparers or CPAs, please always confer with your tax-preparer on these and other tax strategies that we discuss.