The biggest Social Security change in decades

An enormous Social Security change just happened. Are you one of the three million this change impacts?

Last week, President Biden signed into law the “Social Security Fairness Act”. And this signing repealed two major provisions of Social Security: The Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

WEP and GPO had both been in effect since President Reagan signed the Social Security Amendments of 1983. The idea behind this act was to prevent “non covered” workers – typically government workers who did not pay into Social Security – from “double dipping” by taking advantage of Social Security’s benefit formula.

Now that these provisions no longer apply, let’s look at who this helps, who it hurts, and the next steps to take if you are impacted.

Who this helps

Government employees are the biggest beneficiaries of this repeal; if you fall into one of the categories below, it’s worth reviewing to see if this changes your retirement picture.

- Teachers

- Firefighters

- Police Officers

- Air Traffic Controllers

- Other “Non-Covered” Federal Employees

- Pastors

- Anyone with an earnings history like the picture above

Before the repeal, WEP reduced their personal benefits, and GPO reduced their spousal benefits. Now that neither of these apply there is quite literally a windfall opportunity.

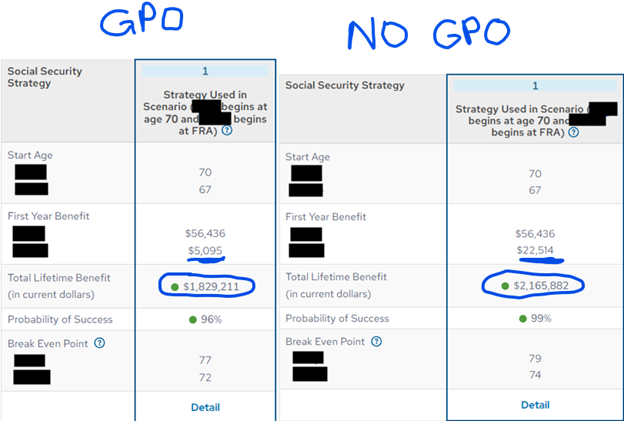

Let’s look at a real-world example and see the enormous impact this change can have.

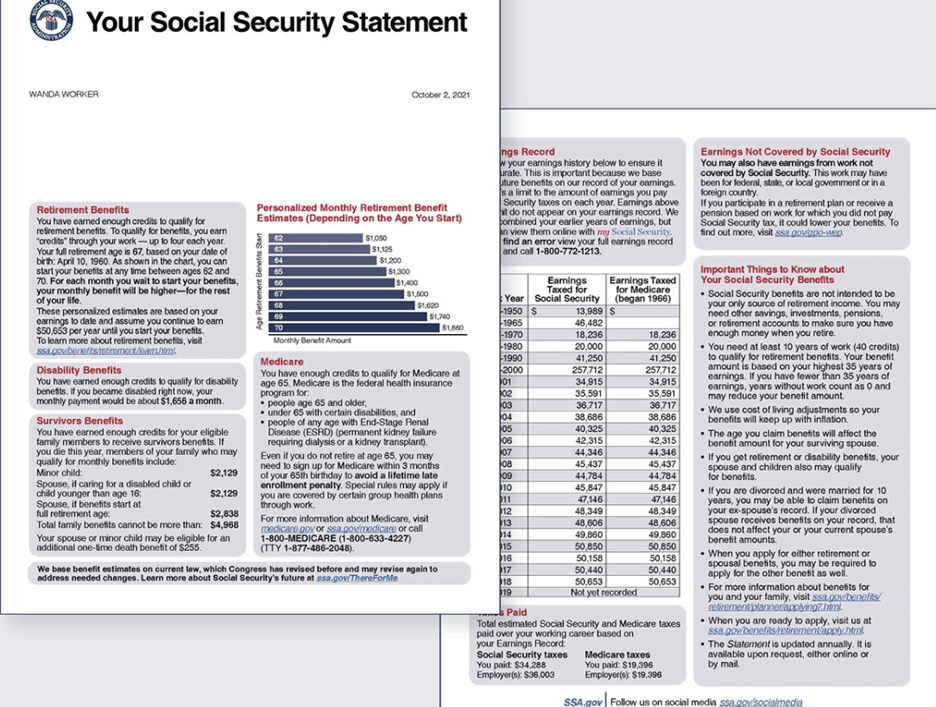

This client is a retired teacher. Her district opted out of paying into Social Security, hence all the zeroes in her earnings history.

Before the repeal, she was not entitled to a personal retirement benefit due to insufficient qualified earnings. As a result, WEP did not apply to her because there was no personal retirement benefit to reduce.

But her spouse has paid into Social Security.

And under the GPO, her spousal benefit was reduced by 2/3 of her monthly TRS pension.

Not anymore. With the repeal, she is now entitled to her full spousal benefit.

What’s the difference? Her spousal benefit increases from $5,095 to $22,514 per year.

This gives her an additional $17,419 per year in additional benefits or an over $300,000 increase in lifetime benefits. A BIG difference to say the least.

Who this hurts

Social Security is currently on track to deplete its reserves by 2035. This repeal speeds depletion up by about 6 months.

The government is going to have to solve this problem sooner rather than later.

In my opinion, this most likely will impact the generations younger than baby boomers (Gen X, Millennials, etc.). Cutting retirees’ current benefits would be political suicide. It will be much easier to reduce the benefits of future recipients than current.

This is why at our firm we reduce the projected benefits of younger clients by up to 25%. That is the amount needed to shore up Social Security’s current deficit.

In short, while this repeal benefits millions it does likely come at the expense of future beneficiaries.

What should I do next?

If you are wondering if this impacts you, the first thing you should do is review your Social Security benefits statement.

Do this by logging into your account at ssa.gov. There you can review your statement. If you have zeros in your earnings history even though you were employed, then this likely impacts you.

Moving forward, Social Security is supposed to automatically apply this repeal to your benefits calculation. Additionally, it is retroactive for 2024 – meaning you should receive a one-time true up for the amount you were entitled to.

However, if you had not filed for spousal benefits because the GPO reduced it to zero, then you need to act and file (if appropriate).

Social Security has created a webpage to provide updates as well.

The bottom line? Review your statement, visit Social Security’s webpage, and call their office if you have further questions.

Even better, review with your financial advisor. Ask them if this impacts you. Does it allow you to retire sooner? Spend more? Stay the course?

In the meantime, call or email us with any questions you have!

Disclosure: The views expressed in this article are those of the author as an individual and do not necessarily reflect the views of the author’s employer Astoria Strategic Wealth, Inc. The research included and/or linked in the article is for informational and illustrative purposes. Past performance is no guarantee of future results. Performance reported gross of fees. You cannot invest in an index. The author may have money invested in funds mentioned in this article. This post is educational in nature and does not constitute investment advice. Please see an investment professional to discuss your particular circumstances.