A Look at Tariffs, Market Swings, and the Power of Patience.

Have You Checked Your Portfolio Lately?

With the recent tariff news and economic uncertainty, it’s understandable if you are nervous. But should you be worried?

The past month has been filled with a flurry of negative economic news, leaving many investors on edge.

What I’ve found interesting is that investors’ reactions seem to follow party lines. One side is surprised to hear the market is down this year, while the other wonders if it’s time to get out of the market.

No matter where you stand, here are four reasons I continue to maintain you should “stay invested” and remain steadfast amidst the uncertainty. Our hope is that ultimately, these facts will alleviate your fears and enable you to stay the course.

So, let’s dive in.

We’ve Been Here Before

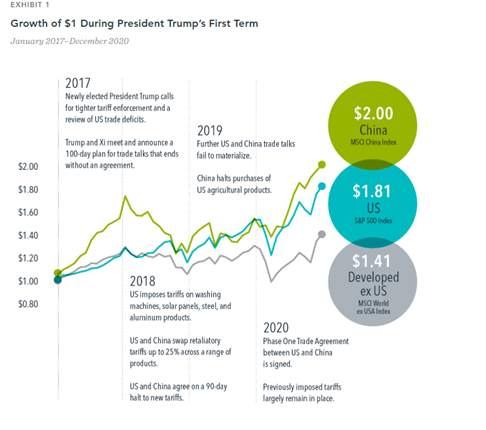

Luckily, we only have to go back to 2018 to see how the market responded the last time tariffs were enacted.

Perhaps surprisingly, as the chart from Dimensional Fund Advisors shows, there was a brief downturn in U.S. stocks in 2018, followed by a strong recovery in 2019.

How did we recover from that downturn? The same way we always have: adaptation.

Adaptation is Our Superpower

There is not an immutable law that says stocks must always and forever go up. It’s not a guarantee.

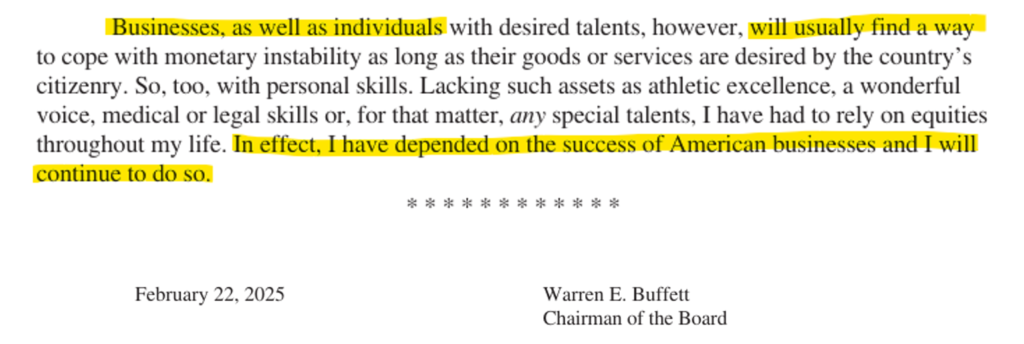

The reason that the stock market – especially in the U.S. – has trended upward for so long is that businesses (and individuals) are incredible at adapting. If businesses don’t adapt, they die and are replaced (see the story of Kodak).

The key to our prosperity is a system that allows businesses and individuals to adapt. As long as businesses are free to adapt, they will “find a way” just as Warren Buffett stated in his 2025 shareholder letter.

This ability to adapt is what has made the market resilient.

Diversification Lets You Sleep at Night

But what if you happen to hold the next Kodak and the stock of the business you own doesn’t adapt? This is why you diversify.

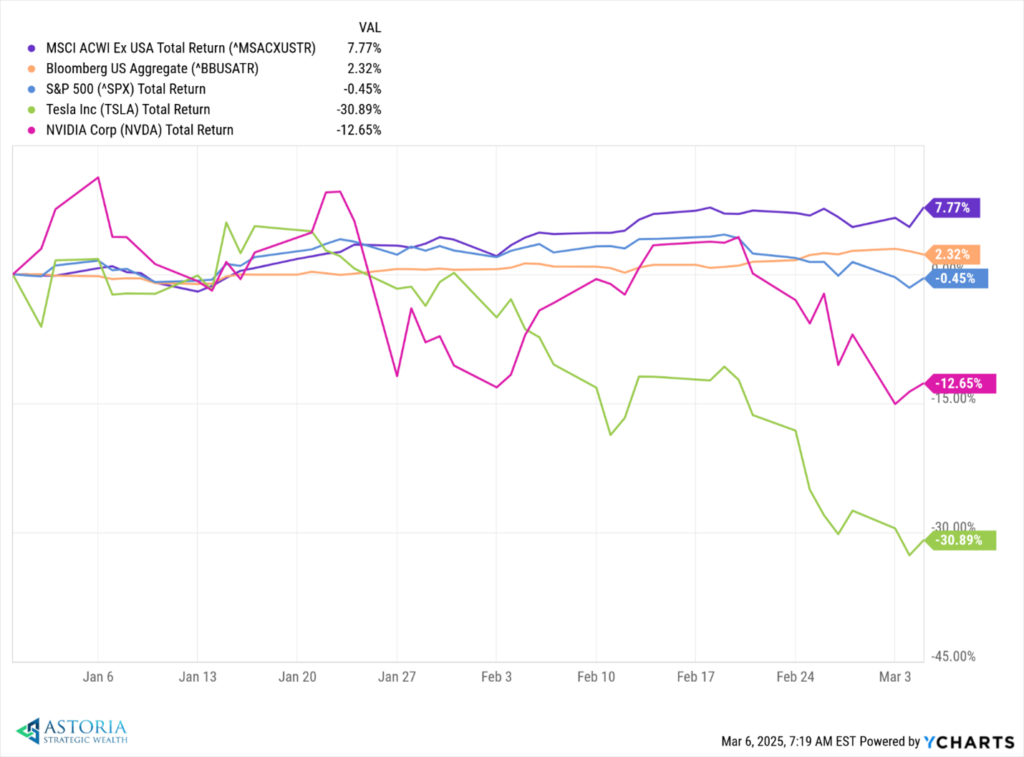

Don’t search for the needle – own the whole haystack.

While most have kept their eyes on the downturn in U.S. stocks, international stocks have performed very well. Bonds have held up too. And all have performed much better than some of last year’s best performing stocks, like Tesla and Nvidia.

Diversification has worked this year.

Sleep comes easier when your eggs are in the basket of the global economy and not a single company.

We Have a Self-Correcting Political System

But what if the political conditions don’t allow businesses to adapt? We’ve got a solution for that as well. If political decisions are bad for the economy, we will vote the politicians out. It’s simple.

Regardless of political views, inflation was the top issue cited by voters in exit polls, which played a major role in the election outcome.

If tariffs (or other political decisions) cause harm to the economy, we believe changes will happen.

Bonus Reminder: The Worst Returns in History

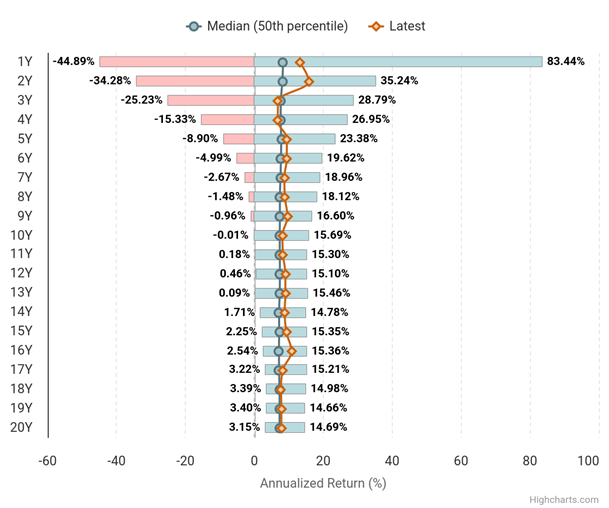

If none of the above helps, here’s a reminder of the worst returns we’ve seen for a 60/40 portfolio over the past 150 years (going back to 1871).

Even in the worst 20-year period for a 60/40 portfolio, a patient investor would have nearly doubled their money. (A 3.15% annualized return over 20 years grows $100 to $185.95.)

And that was during the Great Depression.

Short-term volatility is inevitable. Just consider the range of one-year returns: from -44.89% to 83.44% – a stark reminder of market swings.

But history has shown that staying invested, despite the turmoil, pays off.

Conclusion

Market downturns, political uncertainty, and the accompanying negative news can make it tempting to panic. But history tells us staying invested is the best course. We’ve seen tariffs, and much worse, before and every time the market has adapted and recovered.

Is this time different? Maybe – but we wouldn’t bet on it.

Disclosure: All written content on this site is for information purposes only. Opinions expressed herein are solely those of Astoria Strategic Wealth, Inc. and our editorial staff. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your individual adviser prior to implementation. Advisory services are offered by Astoria Strategic Wealth, Inc., an SEC Registered Investment Advisor. Being registered as a registered investment adviser does not imply a certain level of skill or training.

The presence of this web site shall in no way be construed or interpreted as a solicitation to sell or offer to sell investment advisory services to any residents of any State other than the State of Texas and New York or where otherwise legally permitted. All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. All investing involves risk including loss of principal. Past performance does not guarantee future results.

Astoria Strategic Wealth, Inc. is not affiliated with or endorsed by the Social Security Administration or any government agency.

Images and photographs are included for the sole purpose of visually enhancing the website. None of them are photographs of current or former Clients. They should not be construed as an endorsement or testimonial from any of the persons in the photograph.