Can You Find the False Statement?

Love a quick game? Love learning? Want to improve your personal finance acumen?We’ll post a weekly challenge similar to the popular game “Two Truths and a Lie”. There is no actual “lie” (never a good practice!), but instead it’s a game of finding the incorrect statement followed by a quick explanation of the three statements.

Let’s Play!

Which one of the three statements is incorrect?

Want to learn more about these types of topics? Let us know if you’d like to talk!

Which is the false statement? Scroll down to find the answer.

Let’s Play!

Statement #1:

If your primary home, automobiles, boats, etc.. are titled to your Revocable Living Trust (they probably should be), you should be sure to add your Trust as an “additional insured” to your respective property and casualty insurance policies (to include your Umbrella Policy).

Statement #2:

I can contribute to my Health Savings Account (HSA) if my deductible is high.

Statement #3:

Bunching charitable deductions is a technique by which you combine multiple years of giving into one. Bunching allows you to maximize your itemized deduction in years you give and then leverage the standard deduction in years you don’t.

Statement #1:

TRUE! While seemingly a technicality, lack of adding your trust to a policy can cause a delay or denial of claim. For example, if your house were to burn down, and your house is owned by (titled to) your Revocable Living Trust, if you don’t have the Trust listed as an additional insured on your homeowner’s policy, it can cause problems or delays. Insurance companies love to find reasons not to pay! Note that not all insurance companies will allow the Trust to be added in such a manner so be sure to ask in advance.

Statement #2:

FALSE! Or at least not clear. Having a high deductible on your health insurance plan and having an HSA eligible health care plan are not quite synonymous. For 2024, a health care plan is compatible with an HSA contribution if the plan meets both of these conditions:

- It has an annual deductible of at least $1,600 for self-only coverage and $3,200 for family coverage

- Its out-of-pocket maximum does not exceed $8,050 for self-only coverage and $16,100 for family coverage

Statement #3:

TRUE! Bunching (a funny word, but it works!) your charitable deductions is an effective way to potentially take advantage of itemizing beyond the standard deduction levels. The 2024 standard deduction levels are as follows:

- Single or Married Filing Separately: $14,600

- Married Filing Jointly or Qualifying Surviving Spouse: $29,200

- Head of Household: $21,900

Let’s Play Again!

Statement #1:

Throwing away bills, procrastination, and ignoring spending patterns are all examples of Money Avoidance.

Statement #2:

Money Worshipping is the idea that “money will solve all of life’s problems,” and can lead to becoming a workaholic or taking unnecessarily high risks in pursuit of big rewards.

Statement #3:

Opening new credit cards and making very large purchases without your spouse’s approval is a sign of healthy spending habits and financial independence.

Statement #1:

TRUE! Money Avoidance happens when a person ignores their finances at all costs, which might relieve stress in the moment, but can lead to much more serious challenges down the road, making it very difficult to achieve one’s financial goals.

Statement #2:

TRUE! Money Worshipping is a money disorder that is often associated with behaviors, such as overspending, compulsive buying, and hoarding. The idea being that a person will never be able to accumulate enough wealth or have enough money to be happy. These behaviors often lend themselves to mental and emotional distress, and an inability to stick to one’s financial plan.

Statement #3:

FALSE! It is important for spouses to trust each other financially, and it is important for spouses to communicate with each other, especially when making a big financial decision that could impact their credit score or ability to meet their financial goals. When spouses hide money matters from one another, they may be displaying signs of Financial Infidelity.

Let’s Play Again!

Statement #1:

Examples of the heuristic Affinity Bias are:

A. Investing in Outdoor Sports World stock because you love to fish and hunt, and you are simply wowed by the store,

B. accruing stock in the company you work for because you are so confident in the company’s strength (and heck, you work for them so how could it not be successful?!), and

C. You tried a new beauty product that is nothing shy of miraculous, so you ask your advisor to purchase shares of that company’s stock – it’s truly the fountain of youth.

Statement #2:

Of the five most common divorce methods (Pro-Se, Mediation, Arbitration, Collaborative Divorce and Litigation), the Pro-Se, more commonly known as the “Do-It-Yourself Divorce”, is the least expensive.

Statement #3:

Upholding a Fiduciary Duty includes, at all times when providing financial advice to a client, a duty of loyalty that involves placing the best interest of the client above the advisor’s (or advisor’s firm’s) interest, and transparently communicating and minimizing conflicts of interest.

If you guessed that Statement #2 was incorrect, you WIN!

Statement #1:

True! Those are all examples of an emotional “error” commonly experienced by investors based on liking/believing in a certain company/industry/trend and that affinity will therefore represent their personal financial best interests as well. Accruing too much equity in your own company is a very common error we see so many investors make. A look back at Enron or more recently SVB is a good reminder to stay diversified!

Statement #2:

FALSE! While a Pro-Se Divorce may be the most economical upfront, unless both parties are highly skilled in analyzing a couple’s entire financial picture, it is likely that either or both ex-spouses will encounter effects that neither were prepared for such as income tax surprises, underestimation of retirement plans/accounts and missed assets.

Statement #3:

Also correct! Many advisors are upheld to a ‘Satisfactory Standard’ vs. a Fiduciary Standard. What is your advisor’s standard?

Let’s Play Again!

Statement #1:

Presidential election years tend to have poorer overall returns for a typical Growth and Income portfolio than non-election years.

Statement #2:

The TCJA potential sunset on 12/31/2025 will cause the lifetime estate exemption amount to revert to pre-TCJA levels – in 2017, the individual exemption amount was $5.6M.

Statement #3:

When divorcing, if a couple was on a single spouse’s health insurance plan, the company must be notified within 60 days of the divorce or the company does not have to provide COBRA benefits to the non-employee spouse.

If you guessed that Statement #1 was incorrect, you WIN!

Statement #1:

In fact, Vanguard reports that presidential election years versus non-presidential election years bear NO statistically significant difference in performance returns in a typical 60% stock and 40% bond portfolio.

Statement #2:

That is correct! While the precise amount will be adjusted for inflation, the individual exemption amount starting in 2026 will be approximately cut in HALF for both an individual and married filing jointly couple if no further legislation is passed. Yikes – plan ahead! For frame of reference, the 2024 individual lifetime estate exemption amount is $13.61M. The federal estate tax rate is currently 40%.

Statement #3:

Also correct! The COBRA benefit will allow a non-employee spouse to retain on the health insurance plan of the employee spouse for up to 18 months. The non-employee spouse is responsible for the full payment of premiums and often at much higher rates (unless specifically documented in the final divorce decree).

Let’s Play Again!

Statement #1:

In 2024, if you are 50 or older, your maximum allowable 401(k) contribution is $30,500 ($23,000 for a normal deferral plus a $7,000 catch-up contribution).

Statement #2:

If the TCJA (Tax Cuts and Jobs Act) sunsets on 12/31/2025, the long-term capital gains rate remains relatively unchanged from where it is today.

Statement #3:

The Qualifying Widow(er) filing status on a tax return may be claimed by all widow(er)s for two years after an individual’s spouse dies.

If you guessed that Statement #3 was incorrect, you WIN!

Statement #1:

These numbers are accurate. Check your deferrals to see if you have adjusted your contribution to reach your maximum deferral – especially if you turned 50 this year! (2024)

Statement #2:

If the TCJA (Tax Cuts and Jobs Act) sunsets on 12/31/2025, the long-term capital gains rate remains relatively unchanged from where it is today. If the TCJA sunsets, many other rates will return to their pre TCJA status to include the top marginal rate of 39.6%, deductions that are essentially half of what they are now (with exemptions and phase outs (PEP)), and the Net Investment Income Tax (NIIT) of 3.8% remains in place.

Statement #3:

The Qualifying Widow(er) filing status on a tax return may be claimed by all widow(er)s for two years after an individual’s spouse dies ONLY if the widow(er) has a child living with them whom they claim as a dependent.

Let’s Play Again!

Statement #1:

About 25% of married women consider themselves the primary manager of their household’s financial affairs.

Statement #2:

Roughly ½ of American adults are open to conversations about prenuptials/premarital agreements.

Statement #3:

When surveying female divorcees and widows, one study found that over 70% of these women discovered accounts, other assets or liabilities that they were previously unaware of.

If you guessed that Statement #1 was incorrect, you WIN!

Statement 1:

False! In fact, it’s a much higher percent. Nearly ½ (49%) of women are now claiming the title of Chief Financial Officer for their households, which is on the rise from previous years (Allianz).

Statement 2:

True: A 2023 poll showed that increasing percentages (now ~50%) of US adults support the concept of a prenup to a certain extent, with the younger generations (Gen Z and millennials) being particularly open to these arrangements (Axios).

Statement 3:

Sadly, this is also true and why nearly ¾ of women in transition from death or divorce wish they had taken a more proactive role in the household’s finances rather than trying to reconcile the pieces on their own (UBS).

Let’s Play Again!

The TCJA (Tax Cuts and Jobs Act) is set to expire (“sunset”) on 12/31/2025 if no further legislation is passed. Should the TCJA tax cuts sunset, which of the following statements is incorrect?

Statement #1:

The Long-Term Capital Gains Tax Brackets remain essentially unchanged (with 2017 tax numbers inflated to 2024)

Statement #2:

The Standard Deductions are essentially halved (with 2017 tax numbers inflated to 2024) although Personal Exemptions are back in play with Phase-Outs limitations imposed however.

Statement #3:

The highest ordinary income tax bracket remains at 37%

If you guessed that Statement #3 was incorrect, you WIN!

Statement 1:

True! The Long-Term capital gains rates do remain essentially intact as they are today.

Statement 2:

A;lso True: The Standard Deduction does get more or less halved. Personal exemptions may apply with limits based on income.

Statement 3:

False – The highest ordinary income tax bracket will rise to 39.6%!

Let’s Play Again!

Statement #1:

You have to take Required Minimum Distributions (RMD) from your Roth 401(k) monies.

Statement #2:

The SECURE 2.0 Act raised the RMD age to 75 for people born in 1960 or later.

Statement #3:

Once you reach RMD age, your first payment can be delayed until April 1st of the following year.

If you guessed that Statement #1 was incorrect, you WIN!

Statement 1:

False – Starting in 2024, employees who have money in a Roth 401(k) or 403(b) and similar accounts no longer have to take an RMD from this account.

Statement 2:

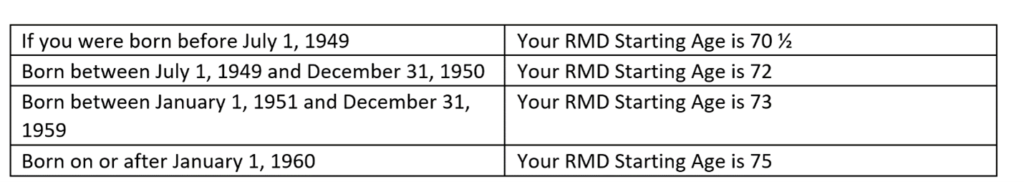

True! The SECURE 2.0 Act raised the RMD age for two groups of people – for those born between 1951 and 1959, the RMD age is now 73. And for those born in 1960 or after, the RMD age is now 75. This legislation did not affect people that started their RMDs prior to 2023.

Statement 3:

True – You do have the option of waiting to take your first RMD until April of the following year. However, if you choose to do this, your second RMD payment still must be taken by December 31st of the same year.

Let’s Play Again!

Statement #1:

Legal separation is an option for some couples that don’t want to live together but don’t want to get divorced (perhaps for reasons of religion or health insurance coverage for example). The state of Texas recognizes legal separation.

Statement #2:

A CDFA Professional is a designation earned by a person specifically trained in handling financial aspects associated with divorce. They may additionally be an attorney, a CPA, a financial advisor or a mediator.

Statement #3:

After 2019, spousal support or alimony was not included in taxable income to the recipient or deductible by the payor.

If you guessed that Statement #1 was incorrect, you WIN!

Statement #1 is False!

Interestingly, the state of Texas is one of the only states that doesn’t recognize legal separation.

Statement #2 is Correct!

A CDFA (Certified Divorce Financial Analyst) studies and trains to assist couples seeking divorce in all financial aspects of the marriage dissolution. They provide support for the attorney and client on financial matters such as property division, tax implications, cost basis and capital gains on the sale of the marital home, analyzing pension and retirement accounts, etc.

Statement 3 is Correct!

People with divorce agreements dated January 1, 2019, or after don’t have to include information about alimony payments on their federal income tax returns since it isn’t considered income or a deduction. However, alimony payments for divorce or separation agreements entered prior to January 1, 2019 are typically deductible by the payor and must be reported as taxable income by the recipient.

Let’s Play Again!

Statement #1:

You are more likely to feel the pain of losing $100 two to three times more strongly than you would feel the joy of winning $100.

Statement #2:

There are 2 general categories of biases: emotional and cognitive error. Emotional biases are typically easier to overcome than cognitive errors.

Statement #3:

Framing, confirmation bias, and herd behavior are all examples of heuristics which are mental shortcuts or tools we use to simplify complex decision making.

If you guessed that Statement #2 was incorrect, you WIN!

Statement 1:

True! Loss aversion states this clearly. We are wired to have a strong preference to avoid losses over acquiring gains. How might this affect your investment style? Investing too conservatively over the long-term may prove to be a detriment in reaching your goals.

Statement 2:

False – Cognitive errors are actually more easily corrected than emotional biases. Cognitive errors are often a result of lack of factual knowledge, whereas emotional biases deal with people’s feelings and instincts. Oftentimes, it’s much more straightforward to shed light on black-and-white facts versus changing someone’s longstanding opinions and impulses.

Statement 3:

True – These three biases are a handful of many biases recognized in the behavioral finance world. We will be publishing more on these powerful concepts in an upcoming blog post.

Let’s Play Again!

Statement #1:

I can pay my tax liability when I file my return, even if I extend.

Statement #2:

When I stop working, my tax rate actually may go UP.

Statement #3:

I have until April 15th of 2024 to make an IRA or HSA contribution for tax year 2023.

If you guessed that Statement #1 was incorrect, you WIN!

Statement #1:

Even if you file for an extension, this only applies to your return due date – your payment is still due by 4/15.

Statement #2:

Yep, it’s true. Your tax rate may go up in retirement! Counterintuitive? Required Minimum Distributions kick in which are distributions from IRAs, 401(k)s and other tax-deferred accounts that must be taken per IRS regulation (see table below). There is often an opportunistic window between the age of retirement and RMD age where partial Roth conversions and tax-bracket management can play a meaningful role in lifetime tax liability. (See chart below to see when you will need to take RMDs).

Statement #3:

You sure do! Some would argue that it’s better to do this at the beginning of each calendar year for that tax year to allow the maximum time for compounding to work for you, but better at the end than not at all. Once that April 15th deadline passes, the opportunity is no longer available for the previous tax year (gone forever)!

Let’s Play Again!

Statement #1:

In 2020, women controlled only about 1/3 of the nation’s household wealth ($10.9 trillion). By 2030, it’s predicted that American women will control close to $30 trillion.

Statement #2:

In 1944, women were granted the right to open bank accounts and apply for credit cards on their own.

Statement #3:

2021 data from the U.S. Census Bureau shows that women who are working full-time earn about $0.84 for every $1 that men earn.

If you guessed that Statement #2 was incorrect, you WIN!

Statement 1:

True! Women are on track to manage an exponentially increasing amount of the nation’s household income. As the baby boomer generation ages, more and more of these women are inheriting wealth from their late spouses (source: McKinsey & Company).

Statement 2:

False – It wasn’t until the Equal Credit Opportunity Act was passed in 1974 (yep, you read that right…1974) that women finally assumed the right to open bank accounts and lines of credit without the need for their spouse’s (or another male’s) co-signature (Source: Forbes Advisor).

Statement 3:

Unfortunately True – While the pay gap is narrowing, women still ultimately earn about $0.16 less than men. One institution suggests gender pay equity won’t become a reality until 2056 (source: Center for American Progress).

Let’s Play Again!

Statement #1:

During the 1950s, 1960s and 1970s, the top federal income tax never dipped below 70 percent

Statement #2:

Transfer-in-Kind means that my positions will be sold to cash and then that cash is transferred to the target account (potentially triggering capital gains/losses)

Statement #3:

My HSA Account Catch-up Contribution age is 55

If you guessed that the definition for Transfer-in-Kind was incorrect, you WIN!

Statement 1:

Painful as it is, the tax statement is true. Our top tax bracket currently is 37% so if you are wincing as you file your return, know that it could be worse!

Statement 2:

It’s also true that the HSA Catch-up Contribution age is 55. IRA and Defined Contribution Plan Catch-up Contribution eligible age is 50 so it’s confusing. Why?! We feel your pain! 🙁

Statement 3:

False – Transfer-in-Kind is simple. It is a transaction in which you move your invested assets from one custodian (ex Fidelity, Vanguard or Schwab) to another custodian. There is no selling or buying of assets, nor there are any capital gains/losses transacted. It IS possible that the custodian that you are transferring from will charge an administrative fee for the transfer, however.

Want to learn more about these types of topics? Let us know if you’d like to talk!

Let’s Play Again!

Statement #1:

The acronym FIRE stands for Females in Retirement Early

Statement #2:

The acronym FOMO stands for Fear of Missing Out

Statement #3:

The acronym TCJA stands for Tax Cuts and Jobs Act

If you guessed that the FIRE acronym definition was incorrect, you WIN!

Statement 1:

While not altogether different in spirit, the acronym FIRE is widely used to abbreviate “Financial Independence, Retire Early”. It is a movement that encompasses early career savings, reduced expenditures and investing strategies that pave the way to retirement or financial freedom sooner than the “standard” age of 65. Another acronym that you might consider adding to your alphabet soup pot is FIERCE – Females in Every Role Changing Everything. Check them out!

Statement 2:

FOMO – Fairly commonly known as the Fear of Missing Out, this condition can wreak great havoc in all sorts of ways – financial and otherwise. Investing FOMO can often lead to “buying high and selling low” – a recipe for losing money.

Statement 3:

TCJA stands for the Tax Cuts and Jobs Act passed into law on December 22, 2017. The entire document (approximately 1,025 pages of light reading-ha!) has many facets, but of particular interest to anyone who pays taxes, the provisions that lowered certain tax rates will automatically expire on December 31st, 2025 barring further legislative updates. What does this mean for you? Tax planning over the time remaining may well benefit those that take advantage of this window. Here’s how.

Want to learn more about these types of topics? Let us know if you’d like to talk!