The Broadening Rally and Election Woes

Most asset classes across the globe have had a good 2024. Equity markets globally continued their strong rally through the end of the third quarter. Notably, fixed income that had largely remained negative finally saw some reprieve when it rallied strongly to post mid-single-digit returns. There has been a lot written about the concentration of market performance in the top ten public companies in the U.S. in recent years. While it is true that there is a historically large weighting of the top ten companies by share of earnings as well as their contribution to the overall market’s performance, it is often overlooked that the composition of the ten names (by market capitalization) is not a static list of the same ten.

At various points in time over the last five years many of the top ten companies have rotated in and out of the listing with the most notable example being Nvidia, which was not even in the top 20 companies four years ago (in 2020), and now sits among the top 5 names. A few other companies that have rotated in/out of the top (in no particular order) over the last five years include Visa, Tesla, Eli Lilly, and Exxon Mobil.

One notable development in the quarter was that the recent rally saw a broadening from purely just the top contributors. More specifically, large-cap growth lagged value stocks and both U.S. small-and mid-cap public companies – something that is nice to see the overall broadening of the market’s rally as large-cap growth took a slight breather.

Inflation has continued to trend down with the most recent core-CPI reading at 2.4% year-over-year for September (Source: BLS). There is nominal progress needed toward the Fed’s 2% inflation target, but surprises with a strong labor market could mean the balance and trajectory gets thrown off, and it is one of many data points to pay attention to in the coming months and how the Fed weighs rate cuts.

The election is now less than one month away, so be sure to get out and vote when the time comes. Recent elections have had a tendency to divide us all, so it is important to be intentional about using this instead as an opportunity to reflect on our similarities – at the end of the day, we are all just people! And, regardless of the outcome and whether the candidate you favor is victorious, markets tend to appropriately recalibrate to each scenario of new laws, tax regimes and incentives/disincentives over the long-term, so the American Dream of building a better and brighter future is never out of reach. Let us not let the differences among us be what prevents us from realizing our mutual (greater) potential together.

Wishing you a great fall and an even better close to the year. Read on as we discuss the rate cut decisions and whether the economy is heading towards a “no landing” scenario.

The Fed Cut rates – what’s next?

At the September Federal Open Market Committee (FOMC), the Fed announced an interest rate cut of 0.5% which brings the short-term target rate to 4.75% – 5.00%. One of the themes we continue to focus on is the forward-looking assumptions that are built into the markets. By the time the Fed made a (somewhat) surprising decision to cut interest rates by 50 bps and left the door open for further cuts in 2024, the markets across most time periods had already seen adjustments underway. Further, while not directly related to the Fed’s actions, but largely related to their signaling of where rates are headed, 30 year mortgage rates only saw modest changes in the last month since they have otherwise been on a steady decline for the better part of the last twelve months. 30 year mortgage rates peaked at approximately 7.75% in October 2023 and have declined significantly by over 1.5% to approximately 6.25% today. With the focus on lower rates in the coming years, most fixed income-oriented assets have already been adjusting under those assumptions for the last year.

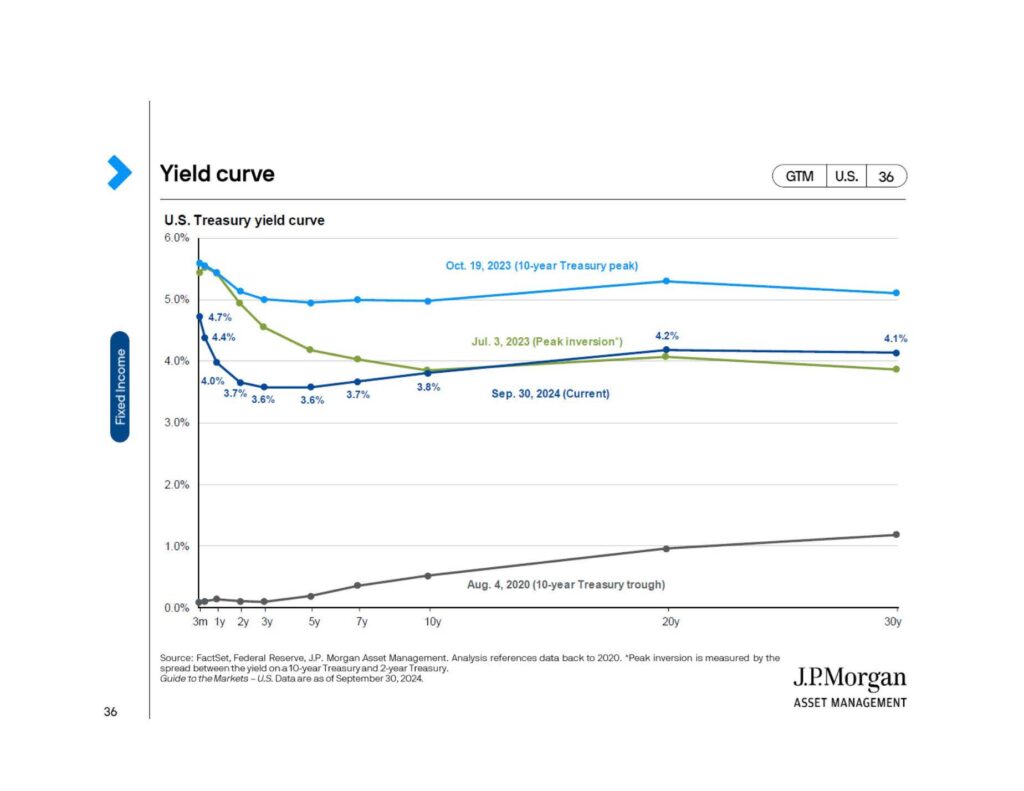

See the yield curve chart below detailing where interest rates were at various points in time over the last four years. The yield curve demonstrates the various market rates for short-term holdings (cash, CDs, money market, etc.), 2 year, 5 year, 10, and 30 year maturities. The chart shows how rates across all maturities have shifted down. Have you checked your savings account rate lately? Across most maturities, interest rates have dropped approximately 1-1.5% since October of last year! And, much of this has happened in front of most of our eyes and serves as further evidence of how it can be incredibly difficult to not only time the stock market, but how it can be equally difficult to time movements in the fixed income markets.

Could we be heading towards a “no landing” scenario?

The 10 year U.S. treasury rate inched back to 4% (Source: Bloomberg) in part due to a strong jobs report released in the first week of October. The strength in the underlying economy has already caused participants to temper expectations for further rate cuts this year if growth and inflation reaccelerate. But, watching the play-by-play of what happens from one week to the next and making knee-jerk reactions can often erode value for the long-term investor, so it’s important to instead take a step back to focus on the overall trend for where we as an economy and country are headed over the next five-plus years. If markets get “spooked” and decline precipitously along the way, the patient long-term investor can often pick up on good market opportunities by simply “rebalancing” or deploying idle cash that is otherwise intended for the long-term portfolio.

The focus of the last few years has been centered on how the U.S. economy can narrowly avoid a recession and experience a “soft landing,” but evidence continues to build on a “no landing” scenario where the economy not only avoids a recession, but where the economic, earnings, and inflation data remains stronger than expected.

Many were forecasting that a recession was on the horizon in the spring of 2023, yet we are now 18 months past that point, and a text-book definition of a recession has yet to happen. There have been significant portions of the economy that have struggled in the last several years, but the broader picture remains positive for the consumer – housing has approached levels that provide room for some recovery. Sure, things could slip further before resuming their upward ascent, but weakness in housing prices coupled with an environment in the coming years that is likely to see interest rates decline ultimately can mean more disposable dollars in consumers’ pockets as debt servicing levels trend down too.

But, if the last few years have taught us anything about the markets, if someone is sitting on the sidelines waiting for a significant recession and/or 15%+ drop in the markets, that opportunity may not present itself without making significant strides ahead. In fact, since the end of 2022, the U.S. stock market is up over 40% with only a 10% peak-to-trough decline in 2023 and an 8% drop within 2024. So, while a meaningful stock market sell-off is always a possibility – since, most environments have some external catalyst that temporarily derails progress – for those waiting for some larger event to unfold, that opportunity may not present itself if the markets and economy continue to make forward progress as it tends to do in most environments.

With the media, it’s easy to focus on the negatives, but how has your personal and/or business situation improved (or deteriorated) this year? Are there real changes that you can affect now that can build resilience to your plan? How are others in your community faring? Better, worse, or the same?

CLOSING REMARKS

While evaluating how AI could be a benefit to the broader economy and how it could augment our personal lives, many of the largest companies are focusing significant time and monetary efforts to understand the space. Any technology that proves disruptive to the status quo takes time. There can be some incremental changes that happen in the short-term, but much of the economic impact happens over the course of years (and decades) into the future. Rome wasn’t built in a day.

Historically, markets tend to see higher volatility in the two months leading up to an election, so with less than one month to go, things have been (admittedly surprisingly) rather calm. When viewed in isolation, each election outcome could favor one sector over another, but the total collective result across the consumer and U.S. based companies tends to be “up and to the right” over the long-term as the macro themes trickle down to real life changes we can make as individuals or in our businesses. The President can have significant influence, but the balancing powers of the Legislative and Judicial branches of the U.S. help provide checks and balances necessary for change to happen, but hopefully in a less disruptive manner overall, so companies and individuals can appropriately recalibrate. Thinking of the Tax Cuts and Jobs Act of 2017 that is set to revert January 1, 2026, as we all gain clarity on future tax rates (few would argue tax rates would be less in the future given current budget deficits), we can each individually adjust our behaviors, plans, and make decisions accordingly.

Outside of the election, there is not a lot for the market to be spooked about from the inflation and economic data. And, the “no landing” or “soft landing” scenarios are not particularly exciting topics for the media to focus their attention on. But, slow and steady can win the race!

Unfortunately, tensions in the Middle East continue to rise, and there is always the risk of an escalation that creates uncertainty – something markets dislike. However, while developments in global geopolitics can adversely affect entire sectors/companies (or oil for example), the U.S. has a strong ability to pick ourselves up, dust ourselves off, and build a better and brighter future as we work toward improving life, liberty, and the pursuit of happiness.