The #1 Service People Want

What’s the #1 service people wish their financial advisor would provide? Tax planning. According to a recent survey, 90% of the nearly 1,600 investors surveyed wish their advisor would help them reduce their tax bill via tax planning. People like to save money on their taxes – who knew? And with year-end approaching, the clock is ticking on several of the most impactful tax planning opportunities.

Let’s explore three strategies to consider that can help mitigate your lifetime tax bill.

Tax Gain Harvesting

First, let us start by also referencing Tax loss harvesting – another impactful strategy. See this article for an explanation of this strategy as well.

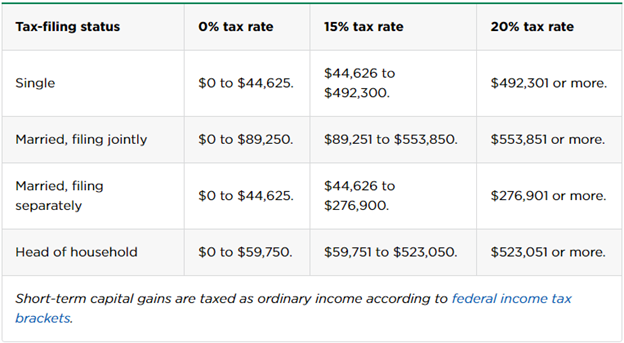

Tax gain harvesting is a lesser-known but very effective tax strategy also. The big idea here is for an investor to take advantage of the 0% capital gains bracket. For a married couple filing jointly in 2023 this amount ranges from $0 to $89,250 in taxable income – a fairly generous bracket. An investor in this income range can sell a security with an embedded gain but not pay any capital gains tax. This is a terrific benefit to those who are retired and living off the proceeds from their taxable account. But, it can also greatly benefit those who may not need a portfolio distribution.

Let’s look at an example of how tax gain harvesting works.

Bill and Pamela are recent retirees. Bill received a retirement package from his employer the previous year, and they are still living off some of the proceeds of that package. Bill and Pamela have saved throughout their lifetimes and have a taxable brokerage account in addition to their IRA’s. Since Bill retired last year and Pamela retired also, their taxable income has dropped substantially for this year to $20,000. At the recommendation of their advisor (again, a very smart one), they would like to take advantage of falling in the 0% capital gains bracket. Their advisor reviews their account and selects a security that was purchased for $20,000 and has grown to $60,000 ($40,000 gain). The advisor then sells the security for $60,000 and immediately buys it back for $60,000. Because the $40,000 doesn’t push them over the 0% bracket threshold ($89,250), they pay $0 in capital gains. Then, when they actually need proceeds from the portfolio, the cost basis will be $60,000 rather than $20,000. Assuming they fall into the 15% capital gains bracket when they have retirement income (Social Security, annuities, RMDs, etc.), this effectively saved them $6,000.

https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates

Partial Roth Conversions

Partial Roth conversions are a staple in the year-end tax toolbelt. The idea is to convert (i.e., change) a portion of a pre-tax account to a Roth account. As a reminder, pre-tax accounts like traditional IRAs, SEP-IRAs, rollover IRAs, etc. have NOT had their proceeds taxed. The money was put in tax-free and will be taxed upon withdrawal. Roth accounts are the opposite. Pay taxes now on the money, but no taxes on the distributions in retirement. The decision of pre-tax or Roth boils down to things: income in retirement and tax rates in retirement. If you are going to be in a higher bracket now than in retirement, then it’s better to pay the tax later via a pre-tax account. If you are going to be in a lower bracket now than in retirement, it’s best to pay the tax now via a Roth account. What partial Roth conversions allow you to do is pay taxes now on funds that were originally earmarked for “pay tax later”. Then, they won’t be taxed when you distribute in retirement.

Let’s look at an example to illustrate the potential savings.

Susan is 35 and has worked for a tech-startup that went public. Susan had been granted stock options and was able to exercise and sell enough to take a multi-year sabbatical. In the second year of her sabbatical, she has almost no taxable income and falls in the 12% income tax bracket. In the past, she had been in the highest bracket (37%) and contributed to her 401(k) pre-tax which she rolled into an IRA upon exiting the company. Knowing that she will almost certainly be in a higher income tax bracket than 12% in retirement, her (very smart) advisor recommends they coordinate with her CPA to convert some of her pre-tax IRA into a Roth. They decide to convert up to the 22% bracket, utilizing the full 12% bracket. Susan pays 12% on $33,725 for a total conversion of $33,725 for a total tax of $4,047. Fast forward to Susan’s retirement. She is now 70 and drawing Social Security. Additionally, tax rates have increased because of our government’s spending habits. With Susan’s Social Security income and increased tax rates, she is in the 24% marginal bracket. Now, the tax on $33,725 is $8,094. A $4,047 tax savings. There are numerous additional factors to consider such as: charitable intentions, RMDs, estate objectives, Medicare IRMAA, insurance marketplace premium credits, etc. The bottom line is to keep this tool in your toolbelt to evaluate for use in those lower income years.

Gifting Appreciated Securities

Gifting a charity appreciated stock is one of the most slam-dunk year-end strategies out there. How does it work? First, an investor with a charitable intent needs to have a brokerage account (i.e., non-retirement) with positions that have long-term gains. Second, the intended charity (church or non-profit) needs to have the ability to receive a donation of a security with a brokerage account of their own. The donor then sends the security to the charity and the charity sells it. This provides benefits to both parties. The donor avoids paying capital gains tax on the security. Additionally, if the donor itemizes their deductions, then they also receive a deduction for the full amount of the security. Both of these together can provide big tax savings for the donor. And last but not least, because charities do not pay taxes, they also avoid paying any capital gains when they sell the security. A win for all parties. How much could this save a donor?

Let’s look at an example.

Tom and Mary are a retired couple and would like to gift $20,000 for the church’s benevolence campaign. They are used to writing a check for their monthly tithe but are interested in alternative options after talking with their advisor (a smart advisor, I must say). They have a taxable brokerage account that has grown over the years and one security in particular has grown from $5,000 to $20,000 ($15,000 in gain). They reach out to their church and confirmed the church can receive the security as a gift. So, rather than sell the security and give the proceeds, Tom and Mary gift the $20,000 security to the church. The church then sells it for its $20,000 value. How much did Tom and Mary save in taxes by gifting the security rather than selling the security and gifting cash? If Tom and Mary are in the 15% capital gains bracket, they would save $2,250 by donating the stock and avoiding the capital gains tax owed if they sold. Keep in mind, everyone’s circumstances are unique and will dictate the effectiveness of this strategy. Generally, though, this strategy grows in effectiveness with higher stock appreciation and higher capital gains brackets. As always, consult an expert (CFP®, CPA, etc.) before deciding.

Conclusion

The end of the year can present many tax planning opportunities and these three strategies can help reduce an investor’s lifetime tax bill. Please reach out if you would like help with your particular scenario with respect to the strategies discussed here. The clock is ticking!