Spring and early summer are filled with many opportunities for celebrations and are popular times for a variety of planned transitions in our lives.

Among the customary transitions, May and early June mark a milestone for many students as they move forward to a new stage of life…Graduation! This is also one of the most popular times of year for a different life transition…Marriage!

Most of us at this time of year have (or know) an upcoming graduate or newlywed. If you have a high school grad or set of newlyweds in your life, we encourage you to reach out to your Astoria Strategic Wealth advisor for resources to assist in the transition. Regardless of the life transition, we have compiled a list of positive money habits that can benefit all of us!

Establish an Emergency Fund

The fund should be large enough to serve as your “buffer account,” enabling you to avoid carrying high-cost debt on your credit cards. Use the emergency fund when necessary to pay off a balance beyond your planned, regular cash flow items which will allow you to avoid paying usurious interest rates. Then, focus your saving efforts to replenish your emergency fund ASAP. How large should your emergency fund be? Minimally, it should be adequate to pay off your monthly expenses for the time it would take to find a new job – this tends to be the largest unplanned expense for most. We’ve found it helpful to keep this account separate from your other accounts as dipping into it should be a conscious act – not a matter of routine. Note: Regularly tapping your emergency fund is a red flag that your cash flow plan needs adjusting – see below.

Develop a Cash Flow Plan

Some call this a “budget,” but “budget” can have a negative connotation for some. Whichever you prefer, it’s vital to develop one and implement a means for monitoring it! A cash flow plan is simply what you bring in less what you save and spend. Be sure to include the “cost” of your long-term goals in the savings section of your budget. You may periodically deviate from it, but there is no need to “toss the baby out with the bathwater” when you stray. Think of it as a map; when you get off your intended route, work to get back on the right path as quickly as you can. Be mindful of impulse purchasing; every time you reach into your pocket or purse, you’re making a financial decision, and, if it is an unplanned purchase, you are consequently saying that it is more important than your established goals.

Pay Yourself First (PYF)

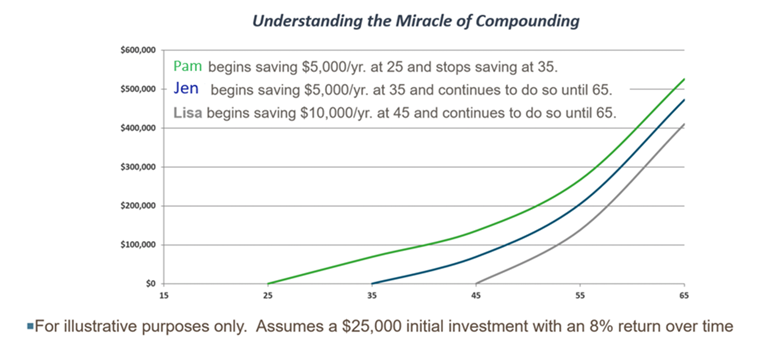

The old-adage of Pay-Yourself-First (PYF) is a good one. Automated savings (at least 15% of gross income as you start out if you can) is the surest method of getting it done. Fill up your tax-sheltered vehicles first, but only after you have accounted for your emergency fund. Never leave money on the table – at a minimum, contribute enough to your 401(k) or 403(b) to get the employer match (‘free’ money). This automatic investment method will help you resist the temptation of spending the “easy access” dollars in your checking account. Recurring savings puts time and compounding interest on your side.

Avoid Consumer Debt - Live Below Your Means

Now this one sounds boring, huh?

We advise all new graduates and newlyweds (and, anyone else who cares to listen) to live below their means and avoid carrying a balance on their credit cards. Credit issuers will try to tell you how much you can afford – decide for yourself what you are comfortable with; this approach will likely produce more restful nights and more of your money to put towards your goals. Outside of rare circumstances, if you are not paying them off every month, you might consider not using them. A good credit score is an asset – we like Credit Karma for monitoring your credit score. Know where you stand!

Don't be Fooled - Looks Can Be Deceiving

Don’t confuse easy access to credit with real wealth. New cars, big houses, and exotic vacations may just be a sign of high debt. Real wealth is usually a result of responsible spending, responsible saving, and trading glamour for modesty and security. Beware of the shiny objects…they are an insatiable habit. You may consider reading The Millionaire Next Door. It is a thoughtful book which helps you develop habits for creating meaningful wealth.

Save Early...and Often

Saving aggressively early can mean having to save less later (when your retirement goals can least afford it). Given that you are likely to work 30+ years, you have to create enough wealth to support you during your last 30+ years. Starting early is key to taking advantage of the compounding. If you start saving 15% of all income sources when you are 22, you will likely be on the path to creating the requisite retirement portfolio. For each decade you wait, add 10%. So, if you haven’t started saving by the time you are 42, you’d need to save 35% of your income – at a time, when you will have the expense of high school/college kids and all the associated costs of cars/school/extras. That can be a difficult (often unachievable) savings rate. The unfortunate consequence tends to be pushing retirement back or reducing the quality of life in retirement.

Honestly Evaluate Needs vs. Wants

Good advertisers can make you ‘NEED’ things you never knew you needed before you saw the ad. Whether it’s through social media, streaming ads on your search engine, or through your television provider, the advertising gurus continue to re-invent ways to keep the money flowing, prompting consumers to feel as if they need something that they typically can go without. Before making a purchase, ask yourself – Is this something I need? If not, is it something I want more than I need to save for my planned goals? Be vigilant about this early on; the rewards can be tremendous. Again, there will be times you stray, but get back on course quickly.

Set SMART Goals: Specific, Measurable, Attainable, Relevant, Time-Bound

Most people seem to navigate life with financial goals that are broad – without setting short-term objectives that are more specific and manageable. Setting more detailed goals, such as determining not just that you want to buy a house but figuring out the size of the down payment and manageable mortgage, will translate into clearer goals. Meeting these interim goals in the short to medium-term will help you stay accountable to your long-term intentions.

Continuing Education

You are your own best resource!

A good financial education can be worth millions – spending the time to educate yourself either through an advisor or through reading will pay for itself many times over. Between podcasts and online publications, there is more information available today than ever before to help increase your financial literacy.

Stay Aware of Lifestyle "Creep"

Whether it’s living up to the Jones’ or a case of FOMO or a delayed gratification spending “emergency”, stay aware at least of the creep effect.

Try to grow into your income slowly, and try to never fully grow into it. Pause before potential expenditure explosions. Referring back to paying yourself first, it can help fight lifestyle creep by accounting for additional savings afforded by income growth prior to any spending increases.

Pre (and post) Marital Communication

Be truly comfortable that you and your fiancé, spouse or partner are having honest money conversations. We promise you that it’s easier to have them now. These are not one-time conversations – keeping the line of communication open is key!